Saving money can feel like a big task. Bills keep coming, prices go up, and sometimes there’s just not much left over. But the good news? You don’t have to do it all on your own.

GoMyFinance.com is here to help. It’s a simple website made for people like you who want to save money, spend less, and build a better future. You don’t need to be a finance expert. Just bring a goal, and GoMyFinance.com will guide you step by step.

In this article, you’ll learn how this tool works and how to start saving money today—even if you’re starting small.

Why Is Saving Money So Important?

Let’s face it. Life is full of surprises. Cars break down. Jobs change. Emergencies pop up. That’s why saving money matters. It helps you:

- Feel safe when something unexpected happens

- Reach your dreams like buying a house or taking a vacation

- Stress less because you know you have a plan

Even saving a little every week adds up over time. And GoMyFinance.com makes it easier than ever.

How to Start Saving with GoMyFinance.com

1. Pick a Goal You Care About

Saving works best when you have a reason. Ask yourself: Why do I want to save?

GoMyFinance.com helps you pick from things like:

- Emergency funds

- Paying off debt

- A big trip

- A new car

- Retirement

Once you know what you’re saving for, you’ll feel more motivated to keep going.

2. Make a Simple Budget

A budget is a plan for your money. It shows how much you earn, how much you spend, and how much you can save.

On GoMyFinance.com, making a budget is easy. You just type in:

- How much money you make

- Your monthly bills and spending

- What you want to save each month

It shows you where your money goes and helps you make changes that save more.

3. Set Up Auto-Saving

Here’s a smart trick: save money without thinking about it.

GoMyFinance.com lets you move money into savings automatically every time you get paid. You can:

- Pick the amount

- Choose how often (weekly, bi-weekly, or monthly)

- Relax while your savings grow

This is called “paying yourself first,” and it works great.

4. See Where You Spend Too Much

Do you ever wonder where your money goes?

GoMyFinance.com breaks your spending into groups, like:

- Food

- Shopping

- Subscriptions

- Entertainment

You’ll see where you’re spending more than you thought. From there, it’s easy to cut back just a little and save a lot over time.

Smart Ways to Save More

1. Cut Back on Small Things

You don’t need to stop all the fun stuff. Just try to spend less where you can. Try these ideas:

- Make coffee at home instead of buying it

- Cook dinner more often

- Use coupons or discount apps

- Cancel services you don’t use (like streaming or gym memberships)

These small changes can save hundreds each month.

2. Start an Emergency Fund

Life happens. That’s why you need a backup plan.

An emergency fund is money you set aside in case something goes wrong. GoMyFinance.com helps you figure out how much you need—usually about 3 to 6 months of your regular bills—and helps you save for it bit by bit.

3. Use High-Interest Accounts

Some savings accounts grow faster than others.

Look for a high-yield savings account. GoMyFinance.com can show you banks that offer better interest rates so your money earns more even while it just sits there.

4. Plan for Big Purchases

Want something expensive? Don’t just swipe your card. Plan it.

With GoMyFinance.com, you can:

- Set a savings goal

- Choose how much to save each week

- See a progress bar that shows how close you are

This makes big spending feel less scary because you’re prepared.

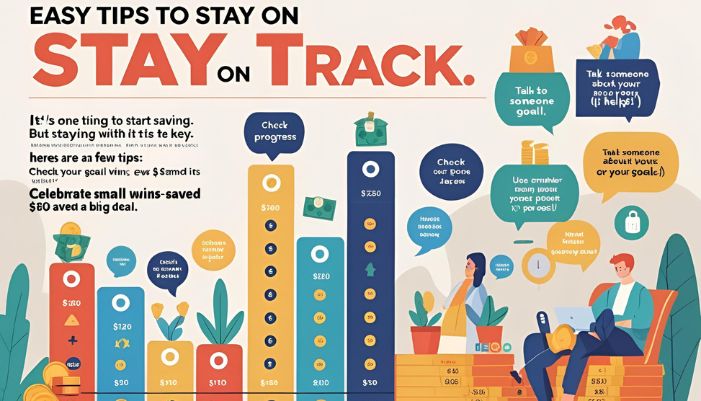

Easy Tips to Stay on Track

It’s one thing to start saving. But staying with it is key. Here are a few tips:

- Check your progress each week

- Celebrate small wins—even $50 saved is a big deal

- Use reminders or phone alerts

- Talk to someone about your goals (it helps!)

With GoMyFinance.com, you can see your progress, which makes saving feel rewarding—not like a chore.

Conclusion

Saving money isn’t about being perfect. It’s about doing your best—and doing it often. Whether you’re just starting out or looking for better ways to manage your cash, GoMyFinance.com is a tool that makes the journey easier.

Remember:

- Pick a goal

- Make a plan

- Save little by little

- Keep going, even when it’s hard

Soon, you’ll have more money in your pocket, less stress in your life, and the freedom to enjoy what matters most.